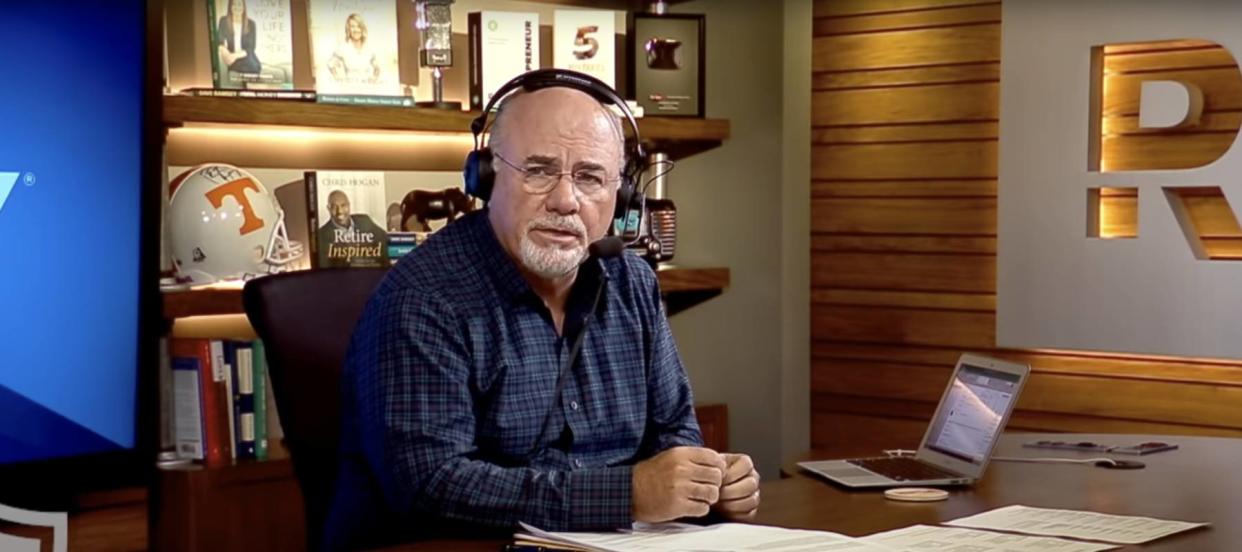

Radio personality Dave Ramsey has been called out online for delivering out-of-touch real estate advice to homebuyers.

“Is it even possible to follow Dave Ramsey’s advice on a mortgage?” one person asked on Reddit — and their skepticism makes sense when you do the math.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here’s how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

See AlsoDave Ramsey, a 22-year-old named Emma and what not to say to parentsExposing the Pitfalls in Dave Ramsey's Financial DoctrineDave Ramsey Tells 29-Year-Old With $1 Million In Debt He's Going To Destroy Her Life As She Knows It – 'Your Friends Are Going To Think You've Lost Your Mind And Your Mother Is Going To Think You Need Counseling'Dave Ramsey is caught off guard by the exorbitant cost of daycare when caller asks for adviceInflation is still white-hot in 2024 — use these 3 'real assets’ to protect your wealth today, no matter what the US Fed does or says

Anything can happen in 2024. Try these 5 easy money hacks to help you make and save thousands of dollars in the new year (they will only take seconds)

The ideal way to buy a home, according to Ramsey Solutions, the finance guru’s website, is to buy it outright in cash.

But if you’re not sitting on a mountain of money, Ramsey Solutions says the only home loan you should consider is a conventional, fixed-rate mortgage with a 15-year (or less) term. Your monthly mortgage payment also shouldn’t exceed 25% of your take home pay.

“I just don't see that happening,” the Redditor wrote, “unless your take home [pay] is more than 20% of the home's value, or maybe if you buy a one-bedroom in the bad parts of the country.”

Are they right that Ramsey’s mortgage advice is unrealistic for most Americans — or are these risk-averse recommendations reasonable? Here’s the math.

Ramsey's preferred mortgage loan

U.S. homes sold in Dec. 2023 went for a median price of $402,045, according to Redfin. For simplicity’s sake, let’s say you buy a $400,000 home with a 20% down payment of $80,000, leaving you with a mortgage principal amount of $320,000.

With a 15-year fixed rate mortgage at 6.66% — the rate as of Feb. 14 — you would have to make a monthly mortgage payment of around $2,815.

For those payments to be no more than 25% of your monthly take home pay, you’d need to earn at least $11,260 per month before taxes — and that doesn’t factor in additional housing costs such as property tax, home insurance and utilities.

Read more: Thanks to Jeff Bezos, you can now cash in on prime real estate — without the headache of being a landlord. Here's how

As the Redditor’s “like, what?!” reaction suggests, that’s a huge amount of cash, especially when you consider the median household income in the U.S. in 2022 (the latest Census Bureau data set) was $74,580, which would leave you with a monthly income of $6,215.

This mismatch was not lost among the Redditors, many of whom acknowledged a high income was needed to follow these guidelines, or that one would need to find a home where prices are well below the national median. Some commenters labeled the advice “unrealistic” or “nearly impossible.”

Understanding Ramsey's rule

You could be doing everything Ramsey suggests — be debt-free, have three to six months of expenses saved in an emergency fund and have enough saved for a 20% down payment on a home — but still struggle to afford a domicile following his 15-year fixed rate mortgage advice.

When a seemingly money-stable man named Robert called into the Ramsey Show to question the host about how to stick to his mortgage advice in pricey metropolitan markets like southern California, Ramsey said: “You don’t get a pass on math because you live in an expensive market.”

Ramsey settled into his argument.

“If you end up with a house payment that is a large percentage of your take home pay, you’re going to struggle financially,” he said. “We call that house poor. If you want to be house poor and blame it on southern California real estate prices, it’s a reasonable blame, prices are high.”

Before looking to buy a house somewhere like San Francisco or Manhattan, Ramsey suggests you ask yourself: “Can you afford to live there?”

He added: “You cannot tie up 40-50% of your income just because you live in an expensive area. That means you don’t make enough to live in that area,” he said. “I can tell you that it is very difficult to prosper financially when you get a house payment that is north of 30% of your take home pay.”

What to read next

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Robert Kiyosaki warns 401(k)s and IRAs will be 'toast' after the 'biggest crash in history' — protect yourself now with these shockproof assets

Credit card debt under inflation's shadow: The 4 potent weapons you need to have for a strong financial resurgence

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.